ACV Auctions, Inc. (ACVA) is an online wholesale used-vehicle auction platform. The platform provides end-to-end solutions that streamline the entire transaction process, including pre-inspection scheduling and post-auction services such as title verification, payment processing, financing, and transportation. The platform allows dealers and commercial partners to optimize used car transactions across the U.S. Founded in 2014, ACV Auctions is headquartered in Buffalo, New York.

ACV Auctions: Leading online platform for used car wholesales with 35.7% upside potential

- Current price14.67

- Entry Price16.95

- Target price23.00

- Position size1

- RiskHigh

- Horizon12 months

- Growth potential56.78

- The U.S. used-vehicle market has remained stable in recent years. In 2021, however, it surged by 40% to $146.8 billion due to supply chain issues affecting new car production. Retail sales remained stable after that, with only a 6.5% decline in 2024 reflecting tight inventory.

- The U.S. used-vehicle market is expected to grow by 1% in 2025, with total and retail sales projected at 37.8 million and 20.1 million units, respectively. This would be the best performance since 2021. Growth drivers include falling interest rates, better access to capital, and a strong labor market. However, inventory constraints are expected to persist.

- ACV Auctions, Inc., operates a digital marketplace specializing in wholesale used-vehicle transactions. The platform provides end-to-end solutions, including auctions, data services, and post-transaction services such as title verification and financing.

- In 2024, the company demonstrated strong growth across its key metrics. Its gross merchandise value increased 8% year over year to $9.5 billion, and the number of active marketplace buyers and sellers rose by 22.5% and 25%, respectively.

- Despite its strengths, ACVA faces profitability challenges. Management aims to address this issue by improving operational efficiency, scaling territories, and optimizing the revenue mix. Financial guidance for 2025 includes revenue of $765–$785 million, non-GAAP net income of $33–$43 million, and adjusted EBITDA of $65–$75 million.

* This investment idea is provided to you as part of the additional service "Investment research and financial analysis" in accordance with License 275/15.

Why do we like ACV Auctions Inc?

Reason 1. Resilient growth of U.S. used-vehicle market

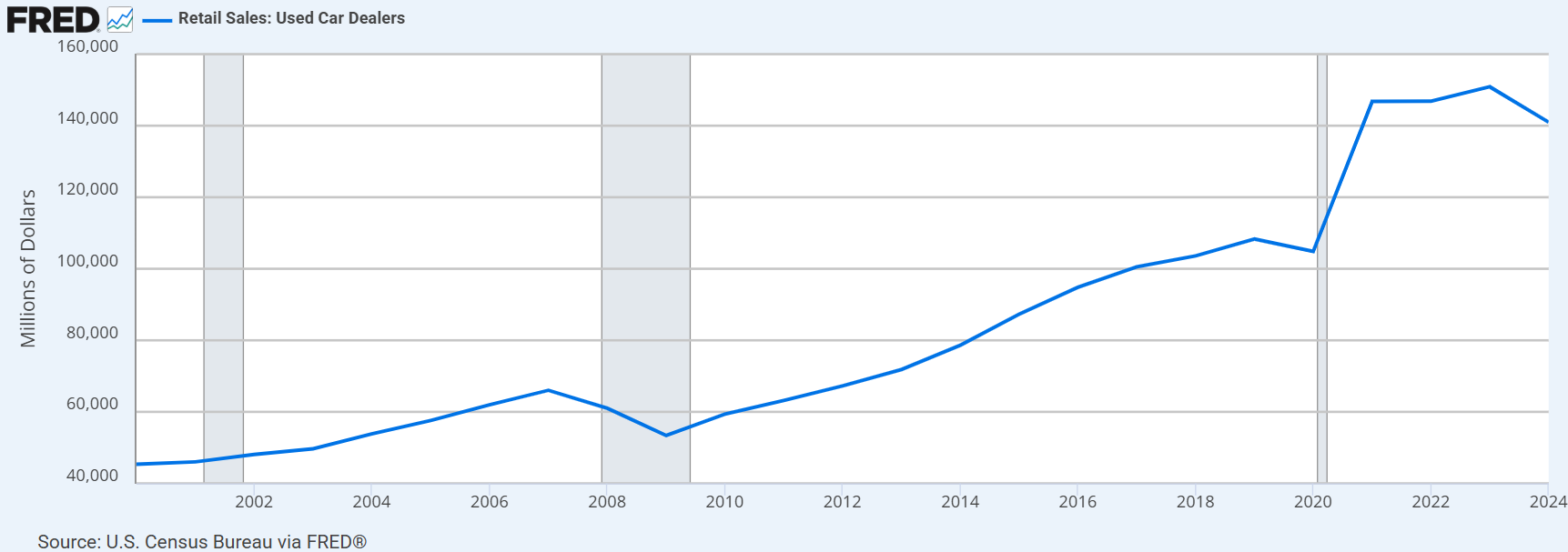

The U.S. used-vehicle market has experienced solid growth over the past decade. According to the U.S. Census Bureau, retail sales of used cars increased from $59.4 billion in 2010 to $104.8 billion in 2020, with a compound annual growth rate (CAGR) of 5.9%. In 2021, due to supply chain disruptions and problems with the supply of new cars, the market surged by 40%, reaching $146.8 billion. Since then, annual retail sales of used cars have remained relatively flat, except for a 6.5% year-over-year (YoY) decline in 2024.

Despite the decrease in sales value in 2024, the used-vehicle market remained strong in terms of volume. Total used vehicle sales reached 37.4 million units, with 19.9 million in retail transactions. The market in 2024 was marked by tight inventory, stable pricing, and robust demand, indicating a gradual return to pre-pandemic activity levels. These dynamics highlight the market's resilience and sustained consumer interest, even amidst evolving economic conditions.

Retail sales of used cars in the U.S.; source: U.S. Census Bureau

In 2025, the U.S. retail used-vehicle market is expected to increase despite ongoing inventory constraints. Cox Automotive forecasts a 1% increase in total used vehicle sales, reaching 37.8 million units. Retail sales are projected to reach 20.1 million units, marking the strongest performance since 2021. Key drivers of this growth include declining interest rates, improved access to capital, and a strong labor market.

However, inventory is anticipated to remain tight throughout 2025. One of the reasons for the inventory constraints is the limited availability of off-lease vehicles due to the reduced number of leases initiated in 2021 and 2022. As a result, fewer lease returns are entering the wholesale and retail used-vehicle markets. This shortage is expected to persist through at least April 2026, further emphasizing the challenges of supply in the market.

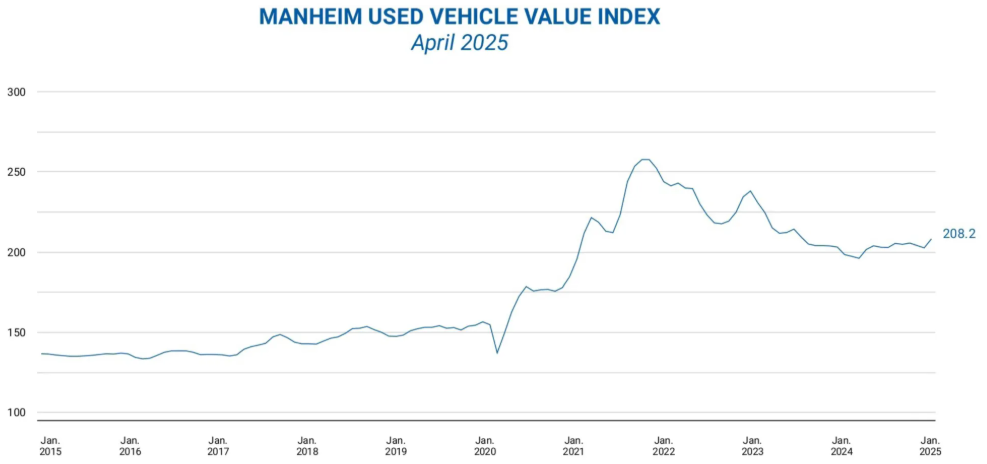

Meanwhile, wholesale used-vehicle prices continued to rise in April, driven by adjustments in mix, mileage, and seasonality. The Manheim Used Vehicle Value Index (MUVVI) climbed to 208.2, representing a 4.9% YoY increase and a 2.7% increase compared to March. This marks the highest reading for the index since October 2023. Looking ahead, the Manheim Index is expected to end 2025 slightly higher YoY, indicating that used-vehicle values will grow at a stable and normal pace.

Manheim Used Vehicle Value Index; source: Cox Automotive

Stable price environment coupled with the rapid digitization of the automotive industry creates significant opportunities for companies embracing the online segment of the used-vehicle market. According to McKinsey & Company, over 95% of used-car searches begin online, with over 70% of consumers using third-party websites to compare prices. Digital-first companies have capitalized on this shift, offering comprehensive used-car marketplaces equipped with value-added services, seamless omnichannel options, and digital financing solutions. These platforms allow customers to explore extensive inventories, compare prices, and access nationwide delivery.

Thus, adopting data-based decision making could allow dealers, OEMs, and auto finance companies to tap into customer demand, increase margins, and improve performance. Consequently, companies that provide these data-based solutions are expected to benefit most.

Reason 2. Diversified business model supported by a suite of data-driven solutions

ACV Auctions Inc. (ACVA) operates an online marketplace platform for wholesale vehicle transactions and data-driven services. The platform provides end-to-end solutions that streamline the entire transaction process, from pre-inspection scheduling to post-auction services such as title transferability verification, payment processing, financing, and transportation. Therefore, it helps dealers and commercial partners efficiently buy, sell, and value vehicles. The marketplace platform is also supported by remarketing centers in various locations throughout the U.S.

ACVA’s marketplace platform offers a suite of products and services:

- Digital marketplace: Its core offering is auctions that are accessible across multiple platforms. Additionally, the digital marketplace offers Run List (pre-filtering and pre-screening of vehicles up to 24 hours prior to an auction taking place), ACV Transportation (transportation of vehicles both locally and long-haul), ACV Capital (short-term inventory financing for buyers to purchase vehicles), and Customer Assurance “Go Green”.

- Remarketing centers: ACVA’s remarketing centers offer value-added services such as vehicle reconditioning and storage to support auction activities with commercial partners. Vehicles processed through these centers can be auctioned onsite or integrated into the digital marketplace, enhancing flexibility and reach for buyers and sellers.

- Data services: The platform’s data services provide insights into the condition and value of used vehicles. These services encompass True360 Report (vehicle-specific assessments that can be integrated into leading vehicle history report providers), ACV Market Report (transaction data and condition reports for comparable used vehicles, including pricing data from third-party sources), and ACV MAX (inventory management software offering).

Thus, ACVA’s marketplace platform, leveraging data and technology, provides a seamless and efficient experience for buyers and sellers in the wholesale vehicle market. The platform ensures transparency by offering detailed and accurate vehicle information to potential buyers, including both dealers and consumers. It also enables dealers to price their wholesale and retail inventory with precision. To further enhance its offerings, ACVA recently introduced ClearCar, an AI-powered suite of tools designed to refine and improve the trade-in process for dealers.

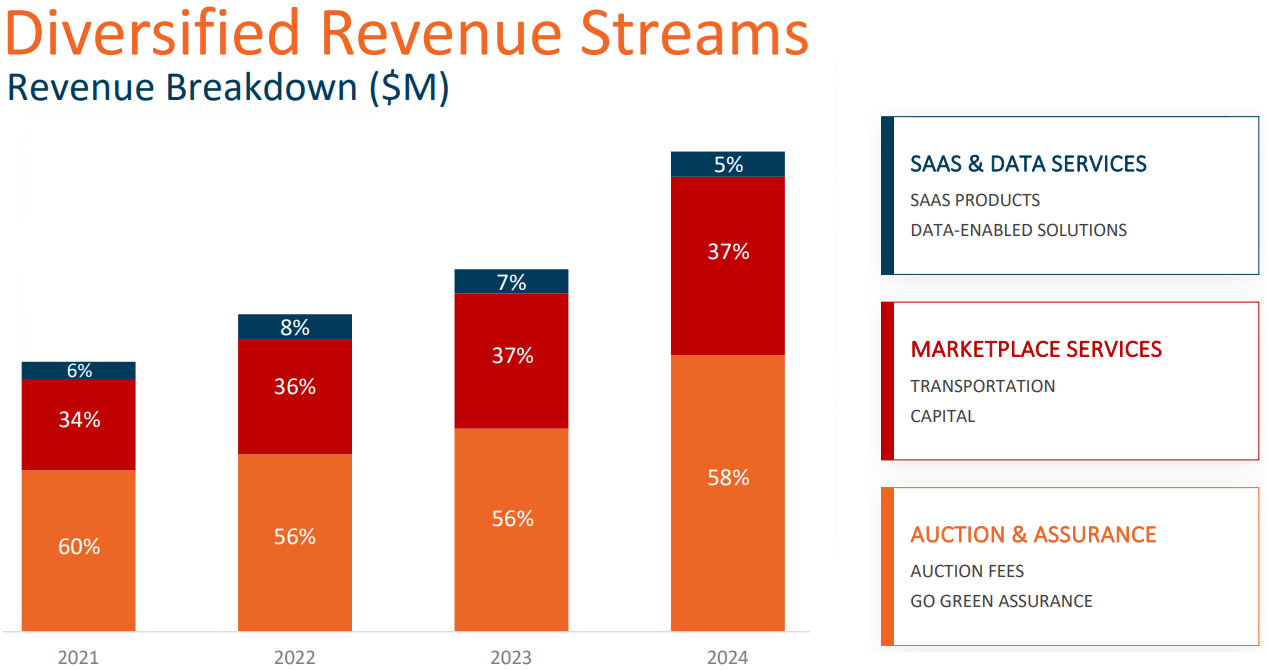

As for revenue streams, they are comprised into three main categories: Auction & Assurance that include auction fees and Go Green assurance (~58% of 2024 revenue), Marketplace Services that encompass ACV Transportation and ACV Capital services (37%), and SaaS & Data Services (5%).

Revenue streams; source: Analyst Day 2025

Thus, ACVA has developed a diversified business model with a comprehensive suite of services that enhance the buying and selling experience for dealers and commercial partners. By leveraging advanced data-driven tools, it delivers transparency, efficiency, and value to its customers.

Reason 3. Scaling growth and targeting profitability with strategic initiatives

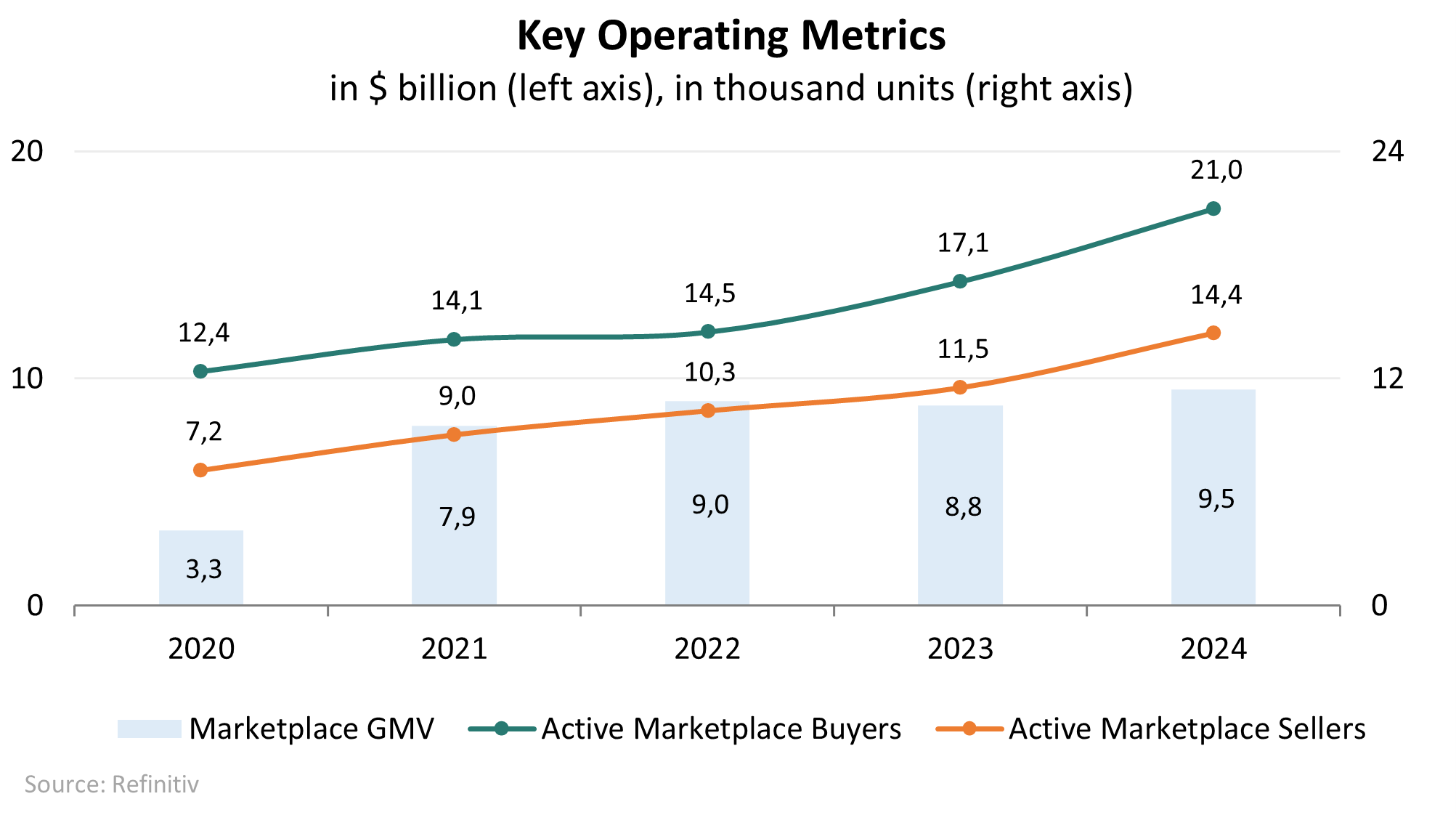

ACVA has showcased remarkable growth of its marketplace over recent years, which highlights its scalability and ability to attract customers. Its performance is measured by three key metrics:

- Marketplace Gross Merchandise Value (GMV) represents the total dollar value of vehicles transacted on the platform, excluding auction and ancillary fees. GMV is primarily driven by the volume and dollar value of transactions. GMV grew by 8.0% in 2024, from $8.8 billion in 2023 to $9.5 billion. Over 2020–2024, GMV achieved a CAGR of 30.3%.

- Marketplace Buyers are independent and franchise dealers that have transacted at least once in the last 12 months as a buyer. The number of active Marketplace Buyers reached 20,975 in 2024 (+22.5% YoY). Over 2020–2024, it demonstrated a CAGR of 14.1%.

- Marketplace Sellers are clients that have transacted at least once in the last 12 months as a seller. Marketplace Sellers include independent and franchise dealers, commercial leasing companies, rental car companies, banks or other finance companies. Their number grew to 14,377 in 2024 (+25.0% YoY). Over 2020–2024, its CAGR amounted to 19.1%.

Key operating metrics; source: compiled by author

To boost further business growth, ACVA is pursuing several strategic initiatives. First, it is focused on increasing marketplace participants by expanding its presence into new territories and onboarding additional commercial consignors. Secondly, the company is strengthening relationships with dealers and commercial partners. This effort is supported by its vehicle condition inspectors (VCIs), who provide high-quality inspection services while maintaining regular customer interactions. Thirdly, ACVA is committed to developing innovative, complementary products to expand its portfolio of data-powered solutions. Specifically, the management focuses on adopting AI across the entire suite of solutions.

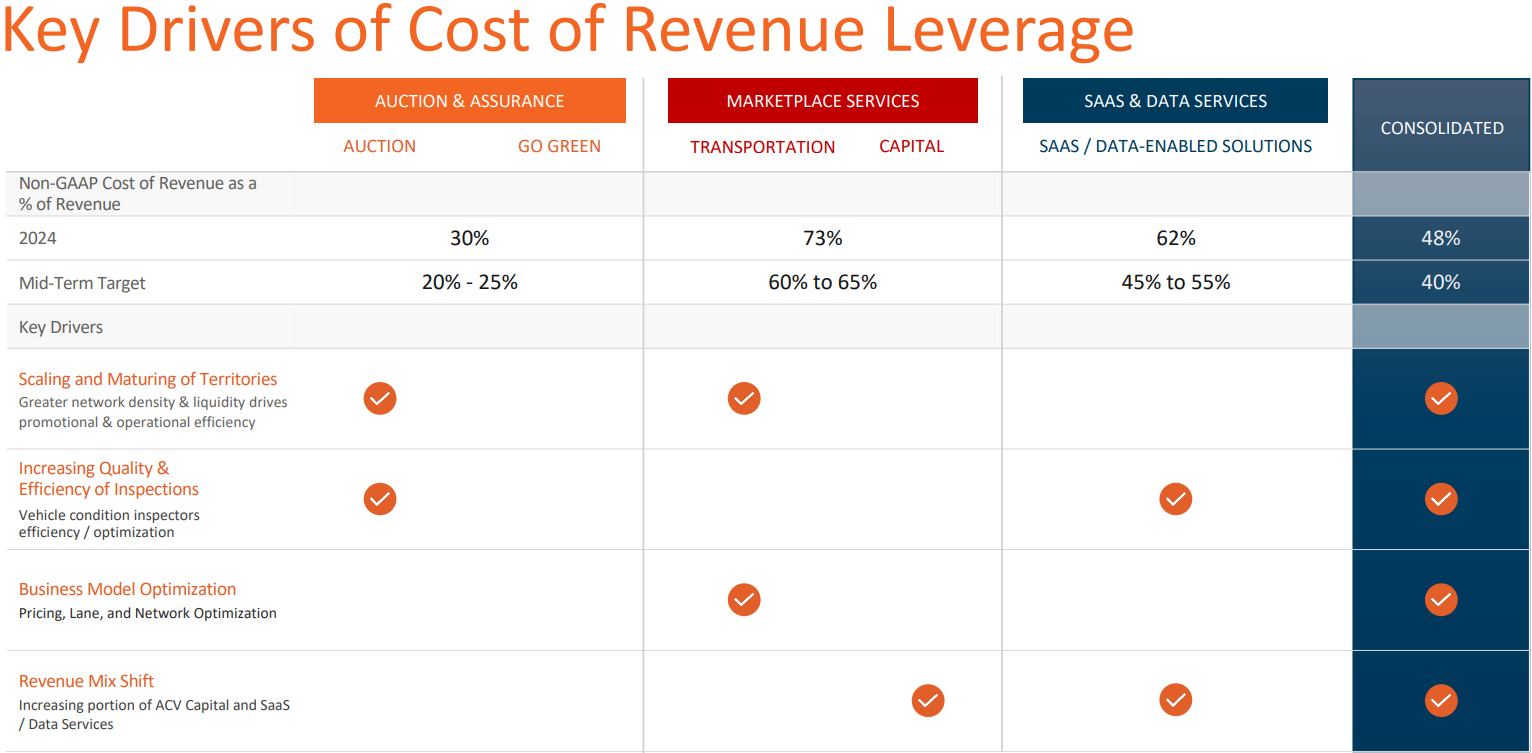

Although the company manages to demonstrate solid revenue growth rates, a key challenge for ACVA remains achieving profitability within its business model. Currently, non-GAAP cost of revenue accounts for 48% of total revenue. The management has outlined a strategy to reduce this figure to 40% in the mid-term, with a focus on operational efficiency and revenue optimization. The management's plan includes several key initiatives:

- Scaling and maturing territories: Improving network density and liquidity to enhance promotional and operational efficiency.

- Increasing quality and efficiency of inspections: Optimizing vehicle condition inspections through improved hardware, enhanced efficiency of inspectors, and the introduction of self-inspection offerings.

- Business model optimization: Refining pricing strategies, optimizing auction lanes, and enhancing network efficiency.

- Revenue mix shift: Expanding the share of revenue generated from ACV Capital and software-as-a-service (SaaS)/data services.

Drivers of cost of revenue leverage; source: Analyst Day 2025

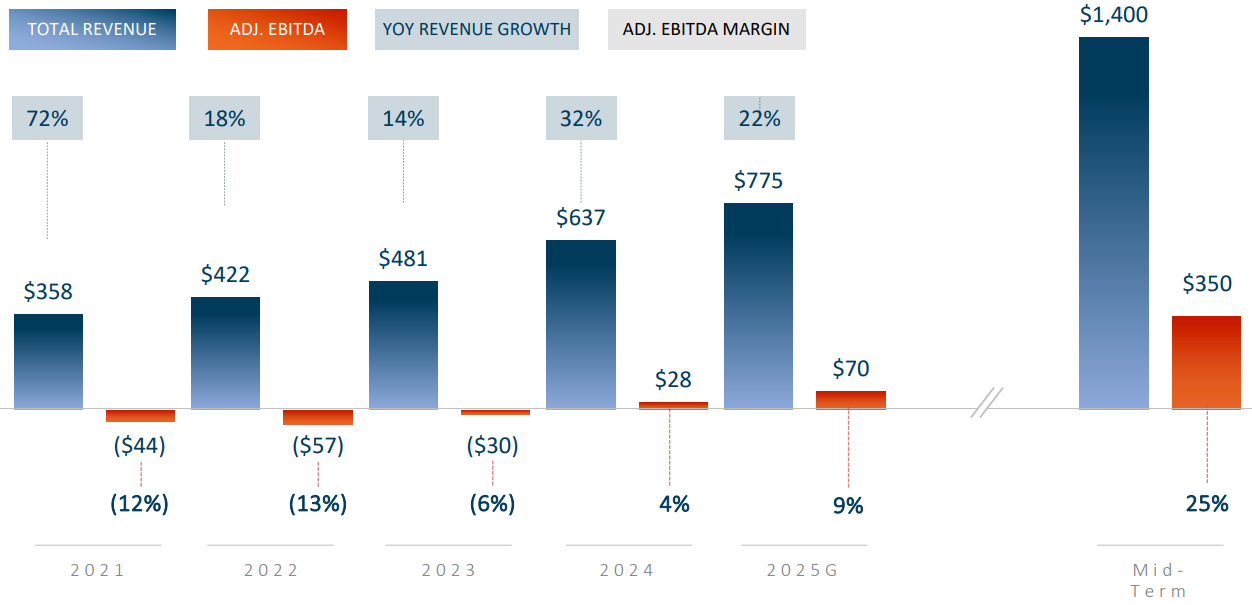

These efforts are expected to drive significant improvements in profitability, with adjusted EBITDA margin projected to rise from 4% in 2024 to 9% in 2025 and further to 25% in the mid-term.

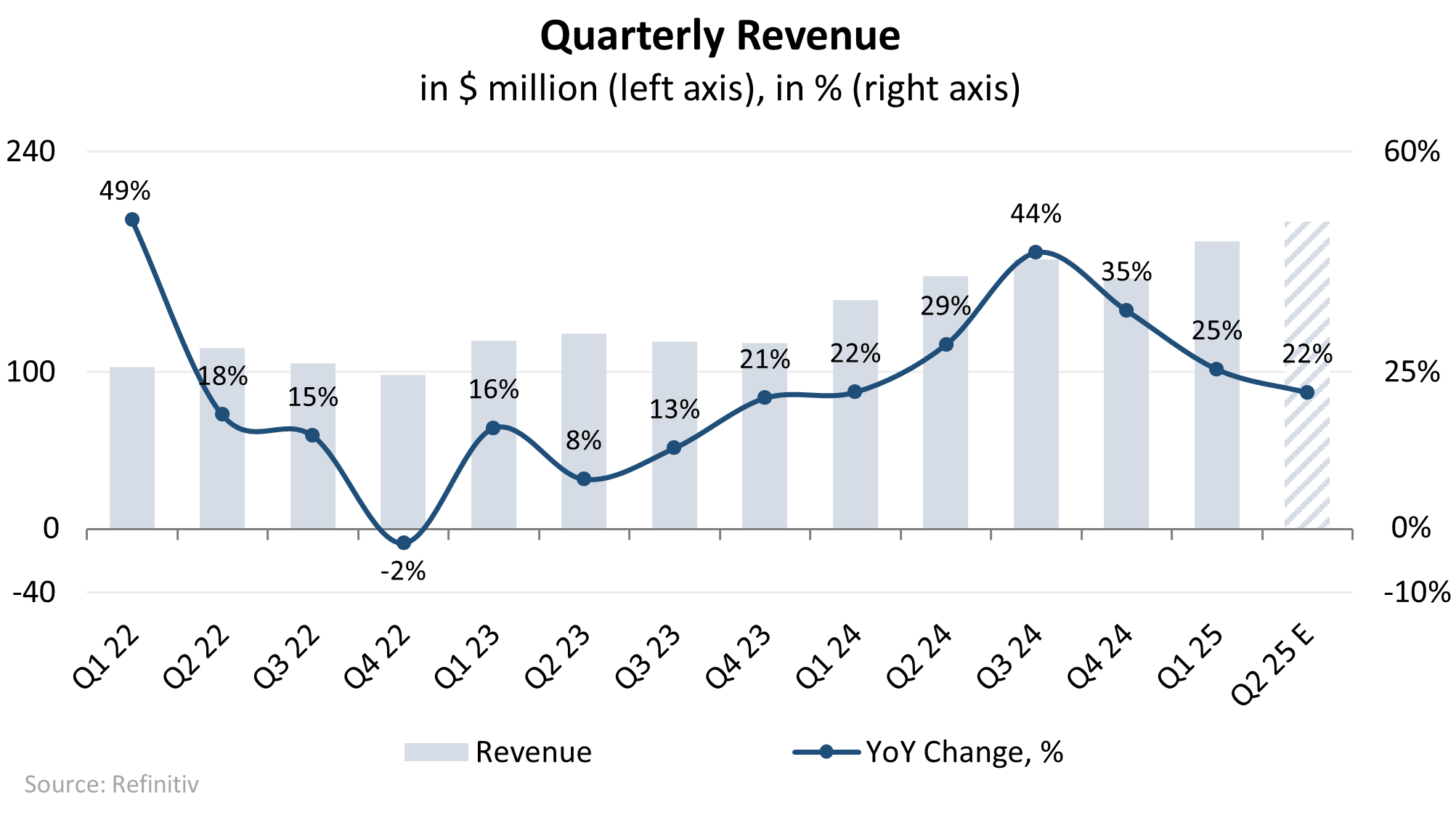

Reason 4. Strong Q1 2025 results and ambitious growth targets

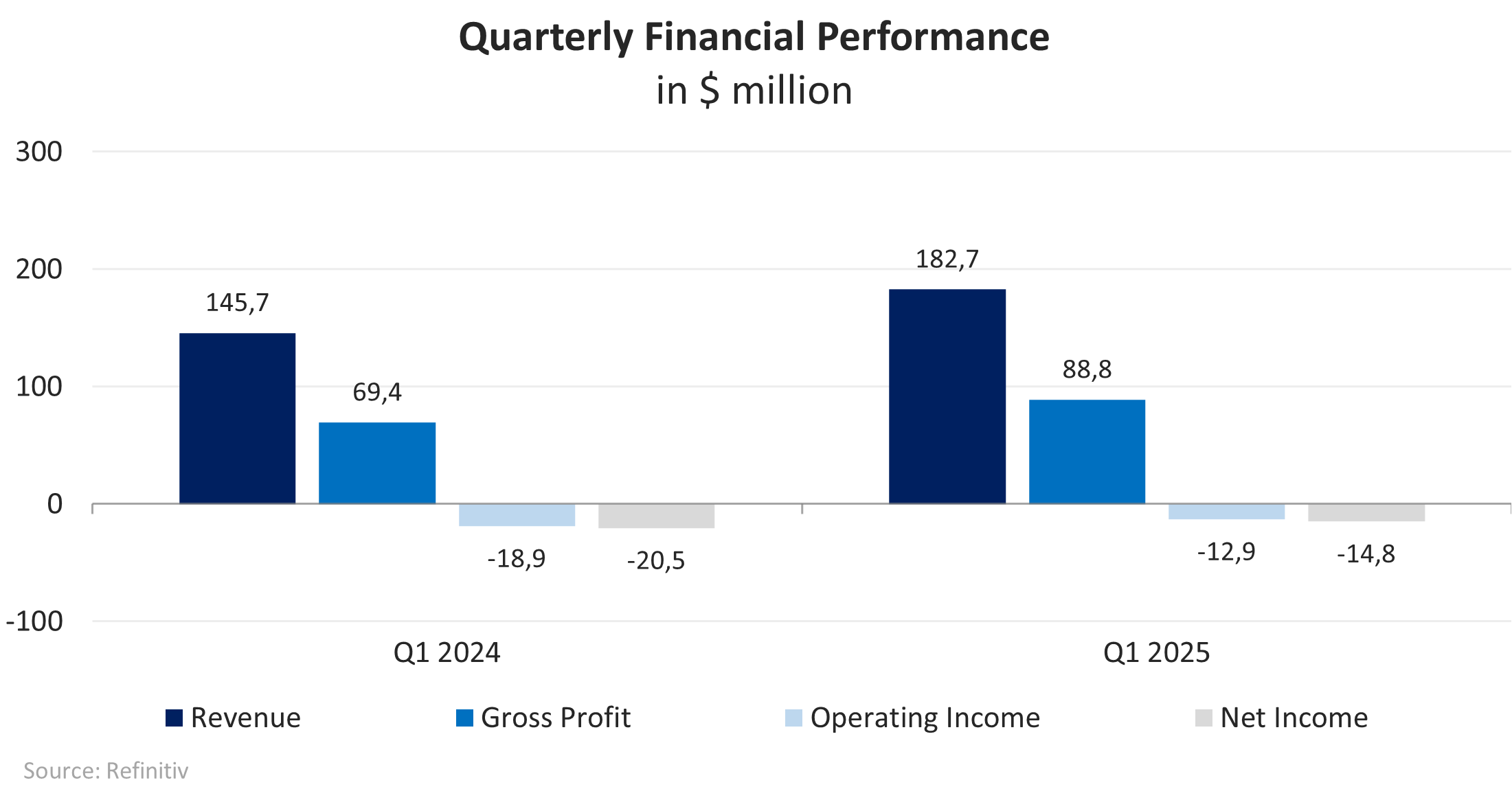

ACVA delivered robust financial performance in Q1 2025. Revenue for the quarter reached $182.7 million, a 25% YoY increase from $145.7 million in Q1 2024, surpassing analysts' expectations of $182 million as reported by FactSet. The company's Auction & Assurance revenue grew 28% YoY, driven by a 19% unit growth and an 8% increase in auction and assurance average revenue per unit (ARPU) to $500. Besides, Marketplace Services revenue rose 24% YoY, setting record revenues for ACV Transport and ACV Capital, while SaaS & Data Services products revenue grew by 5% YoY.

Additionally, marketplace GMV amounted to $2.6 billion, up 13% YoY, with 208,025 vehicles sold on the platform, reflecting a 19% increase in units. These results were driven by continued market share gains and solid execution at remarketing centers and a dealer wholesale market despite soft market conditions in February.

Adjusted EBITDA for Q1 2025 rose to $14 million, a 3.5x increase from $4 million in Q1 2024, with a 500 basis point YoY improvement in margin. The improvement was primarily driven by disciplined operating expense management. Furthermore, the company's GAAP net loss narrowed from -$20 million in Q1 2024 to -$15 million, while non-GAAP net income rose to $7 million from $1 million in the prior year.

Quarterly revenue dynamics; source: compiled by author

On top of that, the company has provided both 2025 and mid-term guidance. For the full year 2025, it expects:

- Total revenue between $765 million and $785 million (20%–23% YoY increase).

- GAAP net loss between -$60 million and -$50 million.

- Non-GAAP net income between $33 million to $43 million.

- Adjusted EBITDA between $65 million and $75 million (130%–160% YoY increase)

Looking toward the mid-term, ACVA aims to achieve $1.4 billion in revenue across its segments:

- Auction & Assurance revenue is targeted at $845 million, supported by market share gains, increased RPU, and total addressable market (TAM) expansion. The company plans to process approximately 1.5 million units, with commercial wholesale vehicles comprising around 15% of the mix. This target assumes an auction and assurance RPU of ~$560.

- Marketplace Services revenue is projected to reach $510 million, fueled by high attach rates and adoption beyond the platform. The plan assumes ACV Transport attach rates will remain near the current ~55% range, and ACV Capital attach rates will reach approximately 25%.

- SaaS & Data Services revenue is forecasted at $45 million. Growth in this segment will focus on delivering bundled offerings that increase wholesale wallet share. The strategy assumes modest growth, aligning go-to-market efforts with bundled software and wholesale services.

Mid-term guidance; source: Analyst Day 2025

Thus, ACVA appears to be a leading digital marketplace platform specializing in wholesale vehicle transactions. Its strengths include robust growth in marketplace GMV, expanding customer base, and innovative offerings like ACV MAX and ClearCar. However, challenges that the company currently faces include achieving profitability and a high competition in the used-vehicle market.

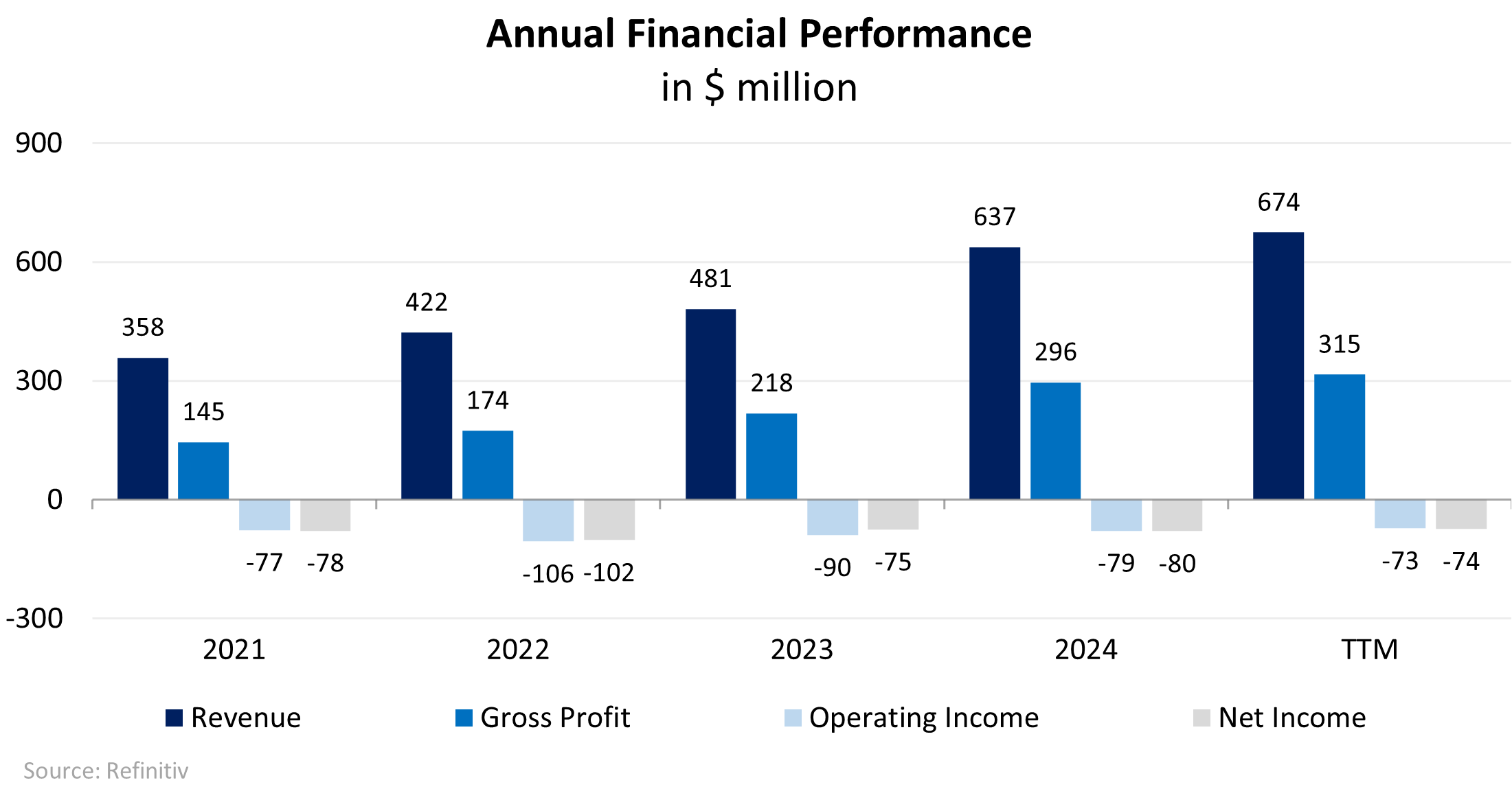

Financial performance

ACVA’s trailing 12 months (TTM) financial results as of March 31, 2025 can be summarized as follows:

- Revenue increased to $674.2 million, up by 5.8% compared to 2024.

- Gross profit grew by 6.6%, from $296.0 million in 2024 to $315.4 million TTM. Gross margin slightly improved from 46.5% to 46.8%.

- Operating loss improved by 7.6% and accounted for -$72.7 million TTM.

- Net loss narrowed by 7.1%, from -$79.7 million in 2024 to -$74.1 million TTM.

Dynamics of annual financial results; source: compiled by author

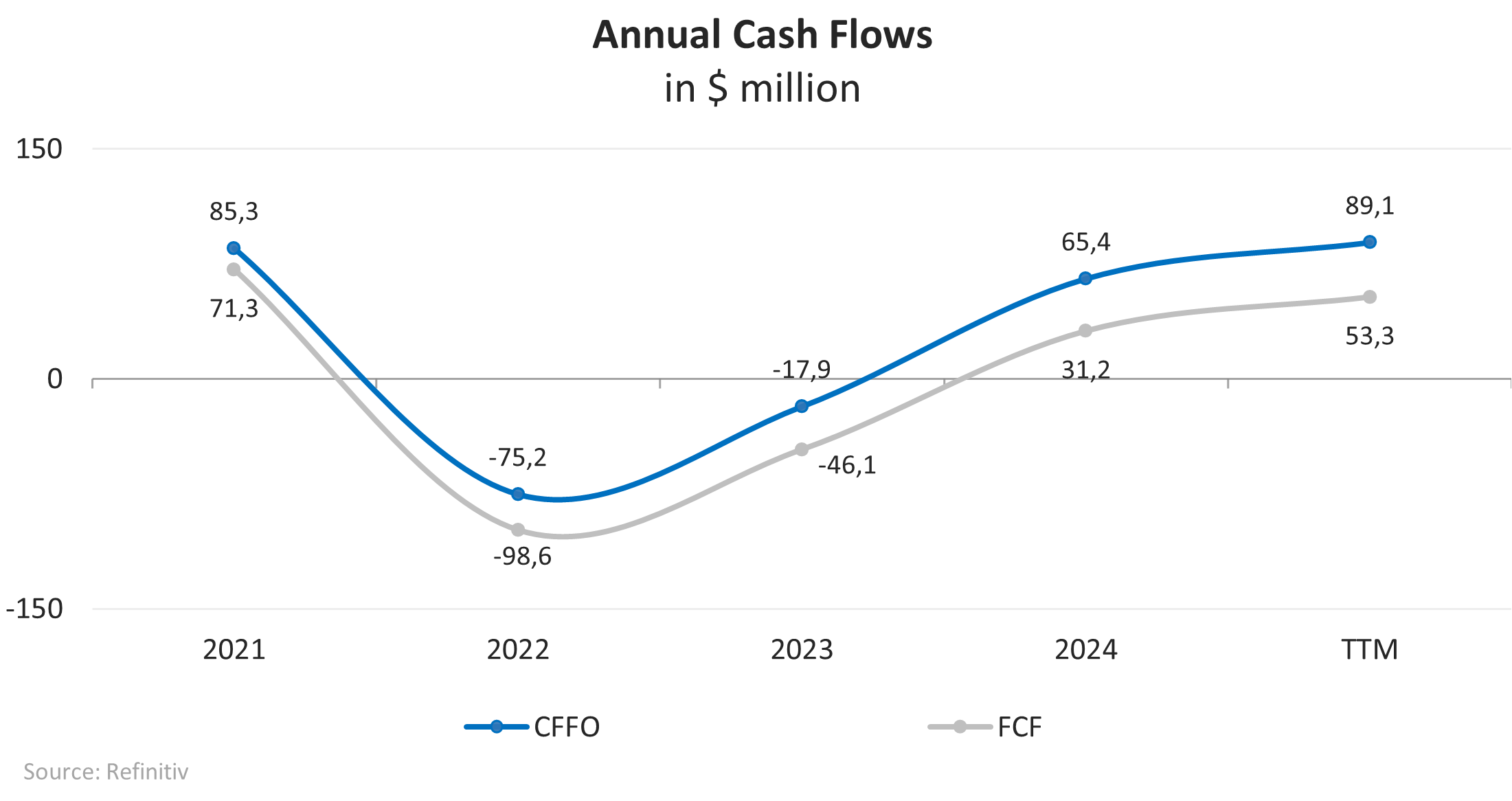

ACVA’s cash flows have fluctuated over the past years but currently they are positive. Its TTM cash flow from operations (CFFO) accounted for $89.1 million, up by 36.2% compared to 2024, driven by improvement in non-cash items and an increase in accounts payable. As for free cash flow (FCF), it soared by 71.1%, from $31.2 million in 2024 to $53.3 million TTM, due to low capital expenditure.

Dynamics of annual financial results; source: compiled by author

ACVA 's financial performance for Q1 2025 is presented below:

- Revenue increased by 25.4% YoY, from $145.7 million to $182.7 million.

- Gross profit soared by 27.9% YoY, from $69.4 million to $88.8 million.

- Operating loss narrowed by 31.4% YoY, from -$18.9 million to -$12.9 million.

- Net loss improved by 27,6% YoY, from -$20.5 million to -$14.8 million.

Dynamics of quarterly financial results; source: compiled by author

ACVA maintains a robust balance:

The leverage ratio, defined as the ratio of total debt to assets, stands at 14%, which is much better than the industry average of 42%.

As of March 31, 2025, total debt accounted for $166.5 million, up by 35.4% from $123.0 million at the end of 2024. With reported cash and short-term investments of $341.8 million, net cash position constituted $175.3 million.

Interest expenses increased from $4.2 million in 2024 to $5.6 million TTM. Although this translates into a 32.8% growth, they remain low in absolute terms. The increase was primarily driven by an increase in borrowings and debt issuance fees.

The debt is represented by a revolving credit facility with JP Morgan Chase Bank dated August 2021 with the aggregate principal amount of up to $160.0 million and a revolving credit and security agreement with CitiBank, providing for a revolving warehouse facility with a maximum principal amount of $125.0 million.

Stock valuation

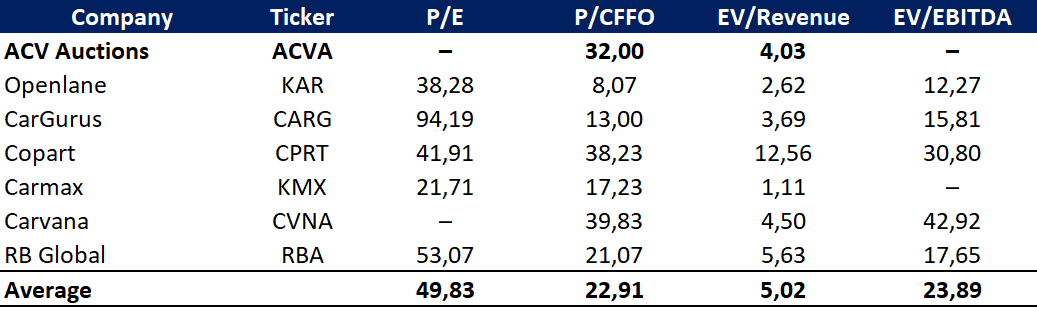

ACVA trades with a premium to its peers based on the average multiples: P/E — N/A, P/СFFO — 32.00x, EV/Revenue — 4.03x, EV/EBITDA — N/A. However, the company operates in a promising market and has an ambitious strategy aimed at business and margin expansion. Thus, it offers a better return per unit of risk taken.

Comparable valuation; source: compiled by author

The minimum price target set by Stephens is $16.0 per share, while Northcoast Research values ACVA at $28.0 per share. According to the Wall Street consensus, the stock’s fair market value stands at $23.0, implying a 35.7% upside potential.

Price targets of investment banks; source: compiled by author

Key risks

- ACVA operates in a highly competitive industry. Its competitors include large physical vehicle auction companies, smaller independent auctions, and digital marketplace companies. Consequently, pressure from competitors may negatively impact ACVA’s business.

- Capacity reductions or supply shortages, including those resulting from supply chain disruptions, could reduce the number of vehicles entering the wholesale market. This could reduce the number of vehicles sold through ACVA’s marketplace, thereby impacting its revenue and profitability.

- ACVA is subject to credit risk resulting from defaults on floorplan loans by its dealer borrowers. A weak economic environment or depreciation in the value of used vehicles could put pressure on dealer customers, resulting in higher delinquencies and losses for ACVA.

- ACVA’s business is sensitive to changes in macroeconomic conditions and risks related to the larger automotive ecosystem. These risks could reduce auto sales and profitability.

- ACVA operates in highly regulated industries subject to extensive U.S. federal, state, local, and international laws and regulations. The wholesale of used vehicles is regulated by states and the U.S. government. These laws can vary significantly from state to state.

* This investment idea is provided to you as part of the additional service "Investment research and financial analysis" in accordance with License 275/15.

**The company may engage in trading the financial instruments mentioned in this material as a counterparty or liquidity provider. However, all recommendations and information provided in this offering are independent and not influenced by the company's trading positions. We take all necessary measures to prevent conflicts of interest and ensure the objectivity of the information provided.

2024 | |

|---|---|

| Revenue | 637.16M |

| EBITDA | -46.57M |

| Net Income | -79.70M |

| Net Income Ratio | -12.51% |

2024 | |

|---|---|

| Debt/Eq | 27.95% |

| FCF Per Share | 0.37 |

| Interest Coverage | -19.82 |

| EPS | -0.48 |

2024 | |

|---|---|

| ROAA | -8.10% |

| ROAE | -18.11% |

| ROI | -14.07% |

| Asset turnover | 0.65 |

| Receivables turnover | 2.07 |

2024 | |

|---|---|

| Gross Profit Margin | 61.04% |

| Net Profit Margin | -12.51% |

| Operating Profit Margin | -13.20% |

First Majestic Silver: a leveraged play on silver